Gold Holds Steady Amidst Market Downturn and Uncertainty

Stable support levels emerge as broader markets experience significant declines.

Buy and Store your Precious Metals with First National Bullion, LLC:

News

Macroeconomic News

JPMorgan Forecasts Base Metals Price Decline in Early 2025, Strong Recovery Expected from Q2

JPMorgan anticipates a near-term decline in base metals prices in early 2025 due to potential U.S. tariffs on Chinese goods and a weakened yuan but expects a strong recovery from Q2 onwards, driven by Chinese economic stimulus and improved valuations. Copper is forecast to reach $10,400/mt and aluminium $2,850/mt by year-end, while zinc remains stable and nickel faces pressure from oversupply. Precious metals are projected to rally, with gold rising to $3,000/oz and silver to $38/oz by late 2025, alongside a platinum surge to $1,200/oz due to supply constraints. Iron ore prices are expected to rebound to $100/t, supported by stronger Chinese steel output, before moderating to $80/t long term. Key risks include U.S. tariffs, Chinese policy measures, and increased supply from major producers.

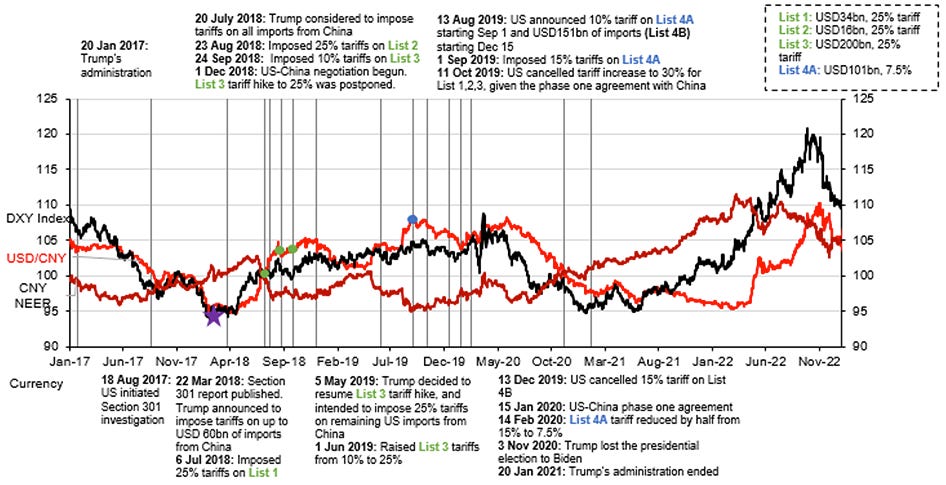

Trump Tariffs will Trigger Global Trade War, with Gold and Silver Set to Benefit

With President-elect Donald Trump set to begin his second term in January 2025, he has intensified his rhetoric on tariffs, targeting major trade partners like China, Canada, and Mexico, along with the BRICS bloc. His threats aim to exert economic leverage in trade negotiations, though they raise fears of renewed global trade wars and economic instability. Tariffs, linked to political pretexts like immigration and drug issues, are also tied to geopolitical moves, such as opposing a BRICS currency initiative. This approach echoes Trump’s earlier administration, which used tariffs as bargaining tools, often resulting in retaliatory measures and prolonged trade disputes.

These tariff threats, especially against BRICS nations, signify an escalation, targeting a bloc with a combined GDP exceeding that of the US and over half the global population. Such actions risk triggering a broader trade war, compounding economic uncertainty, supply chain disruptions, and inflation. While detrimental to global markets, this environment may bolster the appeal of safe-haven assets like gold and silver, as central banks in emerging economies increasingly accumulate these assets to hedge against inflation and geopolitical instability.

The global economic outlook under these conditions appears precarious. Trump’s potential withdrawal from multilateral agreements, coupled with heightened trade tensions, could destabilise international trade norms, prompting retaliatory tariffs and further economic strain. These developments highlight the need for preparation against heightened uncertainty, making gold and silver attractive for their stability amid turmoil.

Read it from the source.

Markets Plunge as FED Signals End to Rate Cuts, Sparking Volatility and Renewed Gold Appeal

The FED confirmed what the markets had been signalling for days: interest rate cuts are coming to an end amid the rebound in inflation. However, a nervous Powell, far from calming the markets, caused long-term rates to rise even further and led to the worst session of the year for equities, with American indices dropping around 3%. Let us remember that this comes after two weeks of market breadth deterioration.

The interest rate scare once again caught investors unprepared, leading to a sharp rise in volatility. It is worth noting that in a very bullish year for equity markets, we have seen two spikes in volatility that rank among the highest in history. This indicates that the market's foundations are not solid, instead relying on extreme leverage and bubble-like behaviour. Even so, on Friday, investors managed to make this a momentary episodic event rather than a trend. However, everything points to 2025 bringing the consequences of the excesses of recent years.

This turbulent financial environment underlines gold's appeal as a hedge against market instability. Rising long-term rates and heightened volatility expose the fragility of equity markets, increasing the risk for leveraged investors. In such scenarios, gold serves as a safe haven, offering stability and preserving value when other assets face sharp declines. Additionally, the FED's challenges in containing inflation suggest continued erosion in the purchasing power of fiat currencies, further enhancing gold's role as a long-term store of wealth. As uncertainty builds heading into 2025, gold's historic reliability during economic upheaval positions it as a prudent investment choice for those seeking to safeguard their portfolios.

China Vows To Open Up Commodity Futures Market

China plans to further open its futures market, allowing qualified foreign institutional investors to trade a broader range of derivatives, including commodity futures and options, according to Chen Huaping, deputy head of the China Securities Regulatory Commission. Speaking at a forum in Shenzhen, Chen emphasised gradual reforms aligned with market principles and laws to support high-standard market opening. This initiative is part of China's broader strategy to promote institutional financial market opening, enhance domestic and international market connectivity, and attract more foreign investment.

Gold News

Gold's historic rally in 2024 is expected to extend into 2025, albeit with a more tempered pace. Analysts predict gold could reach $3,000 an ounce, with a significant rally likely in the latter half of the year. Currently consolidating around $2,650, the market faces mixed influences, including geopolitical uncertainty, central bank demand, and shifts in monetary policy.

Emerging market central banks continue diversifying away from the U.S. dollar, supporting gold demand, while consumer interest, particularly in Asia, remains strong. Despite potential headwinds from higher bond yields and a stronger dollar, gold's resilience is underpinned by stable support levels and sustained buying from central banks and emerging markets, positioning it as a robust asset amid global economic and political uncertainty.

The Core PCE index, the Federal Reserve’s preferred inflation gauge, rose only 0.1% in November, undershooting economists’ predictions and marking a deceleration from the previous month. Annual inflation also remained unchanged at 2.8%, slightly below forecasts. Despite this relief, analysts caution that inflation remains persistently high, limiting the Federal Reserve’s scope for aggressive rate cuts in 2025. While personal income and spending saw declines, robust consumer demand and income growth are expected to sustain economic momentum, providing a mixed outlook for gold’s performance heading into the new year.

Read it from the source.

Silver News

Silver Surges on Rate Cut Expectations and Robust Demand Outlook

Silver prices rose 2.97% as investors anticipated U.S. inflation data suggesting a potential Federal Reserve rate cut, while China’s pledge for economic stimulus bolstered sentiment given its significant commodity consumption. The global silver market faces a structural deficit for the fourth consecutive year, projected at 182 million ounces in 2024, driven by record industrial demand and recovering jewellery consumption, despite a 16% drop in physical investment. Supply growth from increased production and recycling will fall short of meeting demand, with ETPs expected to see inflows for the first time in three years. India’s silver imports surged dramatically in 2024, driven by industrial demand for solar panels and electronics amid depleted inventories and high prices, further underscoring strong market fundamentals. Technically, short covering contributed to price gains as open interest declined.

Read it from the source.

Silver Deficit Persists: Rising Demand Signals Higher Prices in 2025

The silver market is set to record its fourth consecutive year of deficit in 2024, driven by growing industrial demand from sectors like renewable energy and electric vehicles, which are crucial for the carbon reduction transition. While global silver demand is forecast to reach 1.21 billion ounces, supply remains constrained, with production stable and recycling unable to bridge the gap. This sustained imbalance has drained above-ground inventories, putting upward pressure on prices, which are expected to test $49 per ounce in 2025. Without a significant economic downturn or a sharp decline in demand, the silver market is poised for further price increases as it seeks equilibrium.

Read it from the source.

Market Analysis

Gold

The past month has been marked by significant volatility in the gold market, coinciding with a sharp decline in broader markets. A notable accumulation of volume has been observed within the $2,585 to $2,790 range. Currently, the price is supported by a robust level at $2,550, reinforced by diminished volume activity, as indicated through both local profile analysis and a VWAP liquidity assessment.

Technical indicators suggest the potential continuation of the bullish trend that has prevailed since the start of the year. However, there remains the possibility that this pattern represents a distribution phase, potentially signalling a move towards lower levels within the aforementioned range.

Silver

Silver has declined from its previous all-time high in October. According to a report from JPMorgan, a move towards lower price levels in the first quarter (Q1) is highly probable. However, the overall trend and momentum remain positive, supported by increasing Volume Points of Control (PoC), which suggest investor interest in higher price levels. As such, investors can anticipate the continuation of the broader trend in the future.

The rally observed last year was driven by a substantial volume accumulation around the $23 level. Currently, silver is undergoing a retest of the $30 support, which corresponds to a Low Volume Node (LVN) on the Volume Profile.

Macroeconomic Analysis

A Trump victory could provide a favorable environment for gold, driven by policies that may stimulate economic growth and foster inflationary pressures. Potential fiscal stimulus measures, such as tax cuts and infrastructure investments, could bolster demand for gold as a hedge against inflation. At the same time, geopolitical unpredictability and a focus on "America First" policies might heighten market uncertainty, further enhancing gold's appeal as a safe-haven asset.

Additionally, global diversification away from the U.S. dollar, accelerated by Trump's foreign policy, could lead to increased central bank demand for gold. Overall, gold is well-positioned to benefit from the dynamic economic and geopolitical landscape under a Trump administration.

Educational Pill

Gold: A Timeless Hedge Against Uncertainty

In the world of investing, uncertainty is a constant. Markets rise and fall, geopolitical tensions escalate and de-escalate, and economies cycle through growth and contraction. Amid this unpredictability, one asset has consistently stood out as a reliable store of value and a hedge against uncertainty: gold.

A Historical Perspective on Gold’s Resilience

Gold’s unique status as a universal store of value dates back thousands of years. From ancient civilizations using it as currency to modern central banks holding vast reserves, gold has maintained its intrinsic value across eras and economic systems.

The Gold Standard Era: For centuries, the gold standard underpinned global financial systems, providing stability and confidence in currencies. Even after its dissolution in the 20th century, gold retained its significance as a monetary asset.

Periods of Crisis: Gold has historically served as a safe haven during times of crisis. During the Great Depression of the 1930s, gold prices surged as confidence in fiat currencies wavered. Similarly, during the 2008 financial crisis, gold prices climbed as investors sought refuge from collapsing stock markets and banking systems.

Inflation and Currency Protection: Gold has often been seen as a hedge against inflation and currency devaluation. In the 1970s, when inflation rates soared globally, gold prices skyrocketed, protecting purchasing power for those who invested in the metal.

Gold’s Modern Role in Portfolio Diversification

Today, gold remains a cornerstone of prudent investment strategy, particularly for those looking to mitigate risk and enhance resilience.

Diversification: Gold’s low correlation with traditional asset classes, such as stocks and bonds, makes it an effective diversifier. When equity markets decline, gold often rises, providing a buffer for portfolio losses.

Hedge Against Inflation: As inflation erodes the purchasing power of fiat currencies, gold’s value tends to appreciate. This characteristic makes it an attractive option for investors seeking long-term wealth preservation.

Liquidity and Global Acceptance: Gold is one of the most liquid assets in the world, easily convertible to cash in virtually any market. Its universal acceptance ensures that it remains a sought-after asset during both normal and turbulent times.

Why Gold Now?

The current global environment underscores gold’s importance:

Economic Uncertainty: With ongoing concerns about inflation, central bank policies, and global debt levels, gold provides a safeguard against potential economic shocks.

Geopolitical Tensions: Gold thrives during periods of geopolitical instability. Whether it’s conflicts, trade disputes, or shifts in global alliances, these events often drive demand for the metal.

Declining Faith in Fiat Currencies: As central banks around the world continue to print money at unprecedented rates, fears of currency devaluation have made gold a compelling alternative.

How to Incorporate Gold Into Your Portfolio

Investors have multiple avenues to gain exposure to gold:

Physical Gold: Coins, bars, and jewellery offer direct ownership and the satisfaction of holding tangible assets.

Gold ETFs: Exchange-traded funds backed by physical gold provide a convenient and liquid way to invest.

Mining Stocks: Shares in gold mining companies can offer leveraged exposure to the metal’s price movements.

Gold Futures and Options: These financial instruments cater to more sophisticated investors looking to speculate or hedge.

A Golden Opportunity

Gold’s enduring appeal lies in its ability to act as both a store of value and a hedge against uncertainty. Its historical performance, coupled with its modern-day relevance, underscores its importance in any well-rounded investment portfolio. By incorporating gold, investors can navigate uncertainty with confidence, ensuring their portfolios remain resilient and poised for the future.

As you consider your investment strategy, remember: in times of uncertainty, gold is not just an asset—it’s a timeless safeguard.

Buy and Store your Precious Metals with First National Bullion, LLC:

Investment decisions should be made based on comprehensive research and personal financial goals. Consult with a qualified financial advisor before making significant investment changes.

The premier site for precious metals news and analysis