Precious Metals Soar Amid Worldwide Strains

From Dollar-Led Strategic Influence to Silver’s Rise, a Financial Landscape Summary

Buy and Store your Precious Metals with First National Bullion, LLC:

News

Macroeconomic News

Trump’s Leverage Extends Beyond Tariffs as Dollar’s Financial Dominance Offers Coercive Power

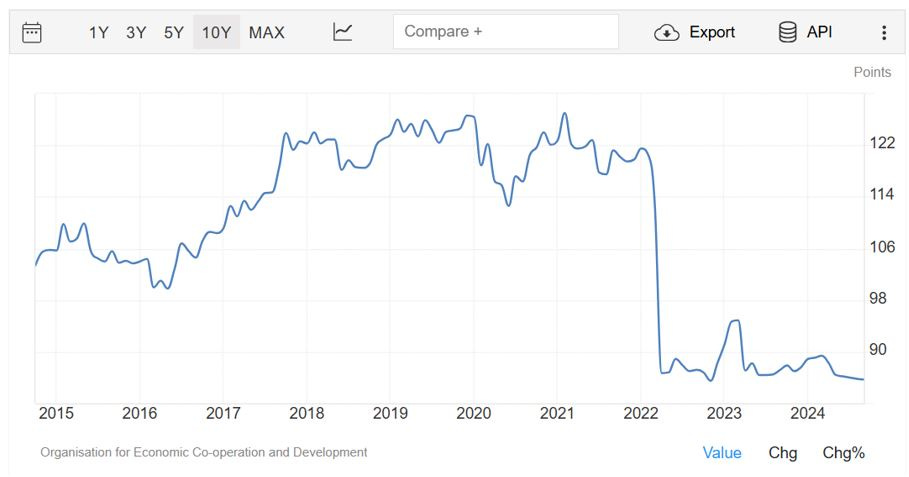

While President-elect Donald Trump brandishes tariffs—threatening Denmark over Greenland and signaling broader trade sanctions—as a key tool of economic coercion, Gillian Tett argues that America’s real leverage lies in its near-total control of global finance through the dollar, which dominates 80-90% of financial services in many nations. The U.S. has long weaponized this power to isolate rivals like Iran and Russia, a strategy Trump’s team, including nominees like Scott Bessent and Marco Rubio, may intensify with ideas like a new Plaza Accord to weaken the dollar or forcing allies to buy U.S. debt; however, such moves risk backfiring by hastening dedollarization—evidenced by Russia’s financial reliance on the U.S. coalition dropping from 94% to 84% between 2015-2022—potentially eroding America’s “exorbitant privilege” and sparking market volatility or worse.

Investors Favor Singapore Over Hong Kong for Precious Metals Storage Due to Stability and Tax Benefits

Amidst Hong Kong’s evolving political and regulatory uncertainties, investors are increasingly relocating their precious metals—gold, silver, and platinum—to Singapore, drawn by its compelling advantages. Singapore’s political stability, independent judiciary, and business-friendly policies provide a secure environment, while its advanced storage infrastructure, exemplified by companies like BullionStar, ensures the safety of bullion with state-of-the-art vaults. The absence of GST on investment-grade precious metals, coupled with no import/export taxes, maximizes returns, and a strong emphasis on privacy appeals to high-net-worth individuals seeking discretion. Strategically located with excellent connectivity and bolstered by government and industry support, Singapore is solidifying its status as a global leader in precious metals storage and wealth preservation, offering a reliable alternative in an uncertain world.

Eurozone Economists Criticize ECB’s Delayed Rate Cuts as Economy Falters

Eurozone economists are sounding the alarm that the European Central Bank (ECB) has been too sluggish in cutting interest rates, with 46% of 72 surveyed by the Financial Times arguing it’s “behind the curve” as the region’s economy stagnates, projecting just 0.9%-1.2% growth in 2025 despite four rate cuts since June lowering the deposit rate from 4% to 3%. Critics, including Eric Dor and Erik Nielsen, warn that the ECB’s cautious approach—attributed to Christine Lagarde’s consensus-driven leadership—fails to counter weakening growth and risks inflation dipping below the 2% target, while a minority like Willem Buiter contend rates are already too low given persistent 2.7% core inflation and record-low 6.3% unemployment. Meanwhile, France has overtaken Italy as the Eurozone’s chief bond market risk due to political upheaval, though economists largely dismiss the need for ECB emergency intervention in 2025, anticipating rates to settle at 2% amid a delicate balancing act.

Ukrainian Drone Strike Halts Oil Exports from Russia’s Ust-Luga Port Amid Escalating Sanctions

An overnight Ukrainian drone assault on Russia’s Andreapol oil pumping station has disrupted oil exports through the Baltic Sea port of Ust-Luga, a vital hub managing roughly 20% of Russia’s seaborne oil via its shadow fleet, exacerbating pressures from EU and U.S. sanctions. The attack, which also struck a missile storage site, is part of Ukraine’s intensified campaign against Russian energy infrastructure as the war’s third anniversary nears, aiming to undermine Moscow’s military and economic resources. Concurrently, EU sanctions reduced Baltic Sea oil shipments by 10% in late 2024, while the Biden administration’s recent measures hit Surgutneftgas and Gazprom Neft—handling 25% of Russia’s oil exports—along with 180 vessels, signaling a tightening grip on Russia’s oil trade amidst aging fleet challenges.

Gold News

Long-Term Gold Demand Fuels as Chinese Bond Yield Collapse among Economic Fears

Chinese bond yields have plummeted to record lows, reflecting growing fears over the country's economic stability, with deflation, weak consumer confidence, and falling property values eroding growth prospects. In response, Chinese households are saving more and turning to physical gold as a safe haven, while the government is discreetly increasing its gold reserves, likely as part of a de-dollarisation strategy and to safeguard the yuan. With bonds and gold both benefiting from risk-off sentiment, and lower yields reducing the opportunity cost of holding bullion, gold demand in China is set to remain elevated as economic uncertainty persists.

Silver News

Silver Poised to Outshine Gold in 2025 Due to Industrial Demand and Affordability

Silver is emerging as a standout investment for 2025, driven by its affordability relative to gold, surging industrial demand, and strong fundamentals amid global uncertainties. With gold commanding a premium, silver is attracting both retail and institutional investors, buoyed by its essential use in green technologies like solar panels and electronics, as well as a persistent supply deficit that enhances its value. Experts predict silver will outpace gold, supported by its dual role as an industrial and investment metal and a favorable shift in the gold-to-silver ratio, while its reliability as an inflation hedge further solidifies its status as 2025’s dark horse in the investment landscape, despite stock market volatility and geopolitical tensions.

Market Analysis

Gold

Gold has continued to demonstrate significant strength over the past month, firmly establishing itself in a sustained uptrend. The price action remains well above the VWAP's first standard deviation, which serves as a clear indication of ongoing bullish control and strong market participation. This positioning above such a key dynamic support zone reinforces the dominance of buyers and suggests that the current trend is not only intact but gaining further conviction. The persistent maintenance of higher lows and higher highs throughout the recent sessions adds structural confirmation to this upward movement, reflecting the underlying health of the trend.

A particularly notable development has been the steady progression of the volume point of control, which has consistently shifted higher in alignment with price advances. This steady climb reflects a significant build-up of trading activity at progressively elevated levels, signalling that investors are willing to transact at higher prices, underlining both strong demand and increasing confidence in the continuation of the rally. The lack of any meaningful volume gaps beneath current levels further reinforces the solidity of the move, as it suggests minimal appetite from sellers to challenge this upward trajectory, at least for now.

In conjunction with these structural factors, technical indicators continue to support a bullish bias. Momentum oscillators show sustained strength without entering extreme overbought conditions, which often precede deeper corrections. The broader market context also lends support to gold’s performance, with safe-haven demand persisting amid macroeconomic uncertainty and persistent market fragility elsewhere. This backdrop, combined with firm technical positioning, suggests that any pullbacks towards support levels are likely to be met with renewed buying interest.

While it remains prudent to monitor for signs of exhaustion or distribution, especially given the proximity to psychological price thresholds and historical resistance zones, the prevailing evidence supports a continuation of the existing trend. The strong alignment of price above key VWAP deviations, the upward migration of the volume point of control, and ongoing indicator strength collectively point towards sustained bullish momentum in the near term.

Silver

Silver has shown a positive but comparatively weaker performance over the past month. Following its previous rally, the price has now retraced towards the VWAP, signalling a loss of immediate bullish momentum and suggesting that the market may be in search of the volume point of control, which remains positioned lower within the range. This behaviour indicates a possible phase of reaccumulation or equilibrium as price action consolidates near historically significant volume areas.

Unlike gold, technical indicators for silver are notably softer, with momentum oscillators reflecting persistent weakness and a failure to recover convincingly from oversold conditions. This lack of strength suggests that buyers have yet to regain full control, and further sideways or corrective price action remains likely in the short term. However, the fact that silver is holding near the VWAP without a decisive breakdown indicates that, for now, underlying support is intact. Should volume begin to increase around these levels and the price manage to stabilise above the VWAP, the potential for a renewed upward move towards the volume point of control and beyond remains, albeit with more caution than seen in gold.

Macroeconomic Analysis

The global economic outlook for 2025 has improved, supported by recovering demand, controlled inflation, and strategic policy adjustments across key regions. The easing of concerns over aggressive U.S. trade measures has reduced the likelihood of a major trade conflict, reinforcing a constructive view on global growth. However, tighter financial conditions in the U.S., alongside persistent geopolitical risks, continue to present notable headwinds that require careful monitoring.

In this context, a balanced strategy remains appropriate, combining selective risk exposure with defensive protections. For defensive positioning, long-duration assets are currently preferred over the dollar, particularly in light of anticipated policy normalisation and moderated inflation trends.

In the U.S., tighter financial conditions are expected to slow aggregate demand, aligning it with potential growth and supporting a gradual return of inflation to the 2% target. The eurozone, following a weak 2024, shows early signs of recovery, driven by resilient consumption, favourable political developments, and a weaker euro. Japan is set for modestly above-trend growth, with wage increases surpassing inflation and the Bank of Japan cautiously adjusting policy. Emerging Asia ex-China continues to benefit from strong growth and stable inflation, while China maintains a target growth rate of approximately 5%, backed by ongoing stimulus and a focus on supporting domestic consumption.

In terms of assets, equities remain moderately attractive, with a preference for diversified exposure across U.S., eurozone, emerging Asia, U.K., and Japan, particularly favouring U.S. small- and mid-cap stocks and cyclical European names. Government bonds are recommended for hedging, especially U.S. 5-year Treasuries and 10-year bonds from fiscally stable issuers such as Australia, New Zealand, and Germany. Corporate bond positioning favours high-quality, short-duration instruments, reflecting compressed credit spreads. In currencies, high-carry developed market currencies like AUD, NZD, GBP, NOK, SEK, and CAD are preferred over the U.S. dollar, alongside selective emerging market currencies such as INR, IDR, and cautiously, MXN.

Educational Pill

Silver: The Dual Advantage for the Modern Investor

Silver stands as an unsung hero among precious metals, offering investors a dual advantage as both a hedge against economic uncertainty and a catalyst for growth. Throughout history, silver has played a prominent role not only as a medium of exchange in coinage but also as an intrinsic asset whose value endures. While it may not enjoy the same mythical status as gold, silver’s legacy as a store of value is equally robust, underpinned by centuries of utilisation and trust.

What distinguishes silver is its unique duality. It is not solely an investment vehicle; its extensive use in modern industry—ranging from electronics and solar technology to medical applications—ensures that demand for silver extends well beyond the realm of traditional finance. This industrial component provides a dynamic counterbalance to its role as a safe haven during times of economic stress. For investors entering the precious metals market for the first time, silver’s affordability relative to gold offers an attractive entry point, potentially enabling greater percentage gains when markets rally, albeit with increased price volatility.

In a diversified investment portfolio, silver can provide an essential layer of protection. Its low correlation with conventional asset classes means that during periods when equity markets suffer, silver may well perform favourably, helping to mitigate broader portfolio losses. In today’s climate of fiscal uncertainty, where inflationary pressures and shifting central bank policies are of growing concern, silver’s capacity to act as a hedge against devaluing fiat currencies is particularly pertinent. Moreover, the burgeoning emphasis on renewable energy and technological advancement is likely to sustain, if not elevate, its industrial demand.

Ultimately, silver represents a balanced proposition for the cautious yet opportunistic investor. Its historical resilience, coupled with modern industrial relevance, positions it as a versatile asset capable of weathering economic storms while offering the potential for robust returns. For those seeking a tangible, time-tested means of portfolio diversification, silver may well be the asset that bridges the gap between traditional security and future-oriented growth.

Buy and Store your Precious Metals with First National Bullion, LLC:

Investment decisions should be made based on comprehensive research and personal financial goals. Consult with a qualified financial advisor before making significant investment changes.